llc s corp tax calculator

We are not the biggest. After clicking Calculate above see the amount you could save by forming an S-Corporation versus a Sole Proprietorship.

Filing A Schedule C For An Llc H R Block

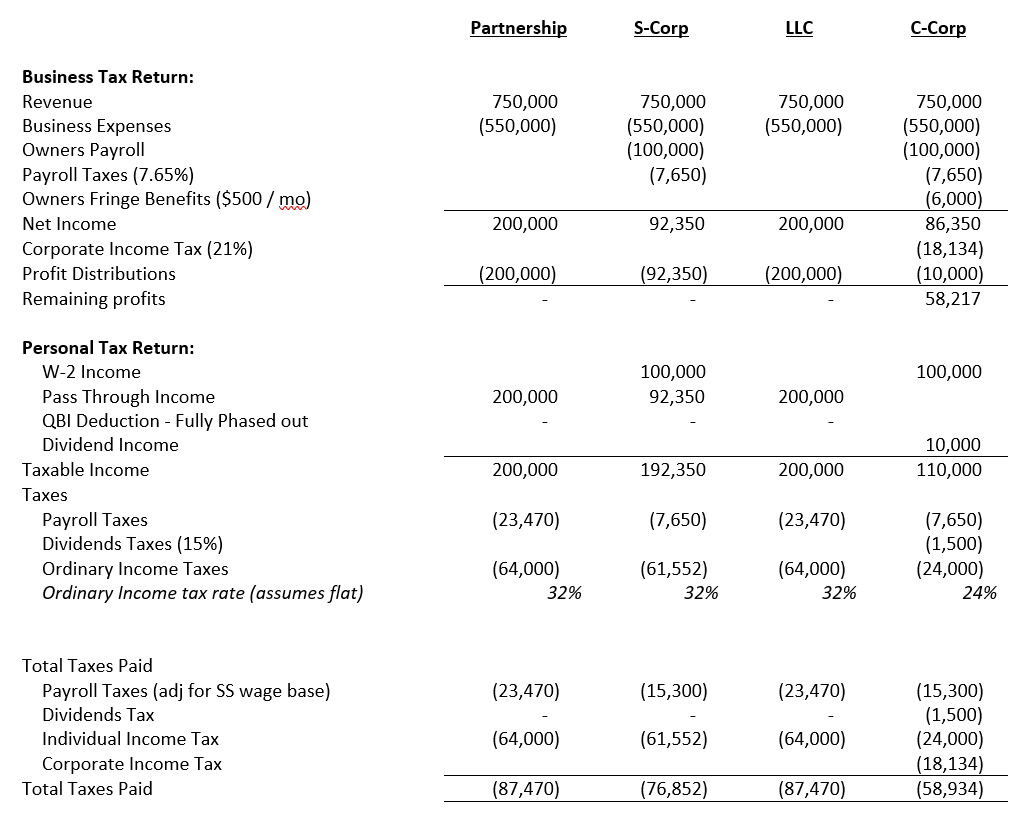

The Main Differences With A C-Corp.

. Taxes are determined based on the company structure. Corporate tax rate calculator for 2020. This calculator helps you estimate your potential savings.

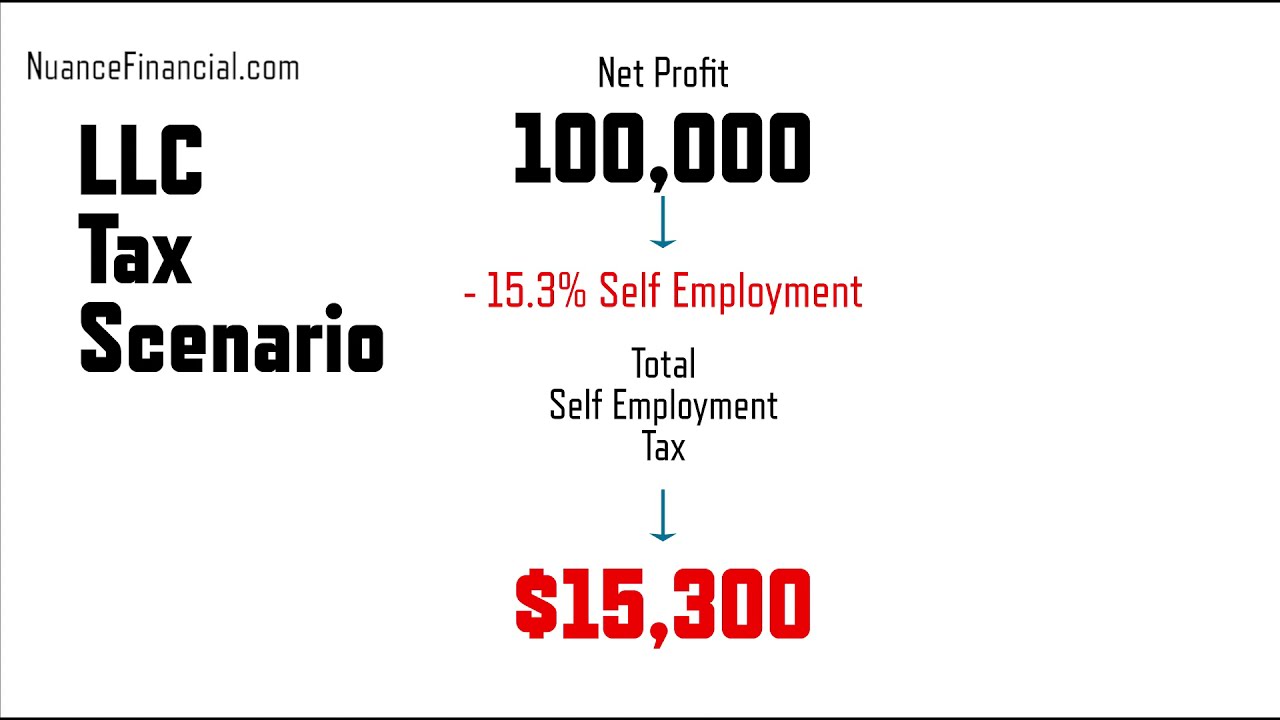

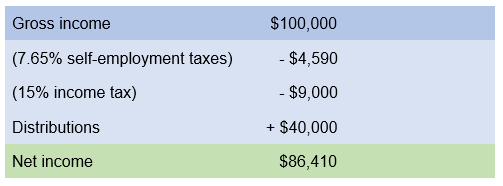

From the authors of Limited Liability Companies for Dummies. Total first year cost of S-Corp. Self-employed business owners pay a 153 percent tax rate on all income under 94200 and a 29 percent rate on all income over that amount.

The LLC tax rate calculator is used by corporations to calculate their taxes. Lets calculate your canadian corporate tax for the 2020 financial year. LLC S-Corp C-Corp - you name it well calculate it Services.

The SE tax rate for business owners is 153 tax. S-Corp or LLC making 2553 election. Annual state LLC S-Corp registration fees.

Forming an S-corporation can help save taxes. Partnership Sole Proprietorship LLC. Find out why you should get connected with a CPA to file your taxes.

S corp owners must also pay. This includes foreign corporations that have Line 8 elected to be New York State Do not include interest or additional charges paid with prior S corporations. Your annual property tax amount will be listed in bold at the bottom of the bill.

How Will A Business Tax Calculator Help Small Businesses. Form 1120 or the taxable income of last year. In that ruling the agency addressed the issue of whether an S corporation can convert to an LLC file an election to retain its tax treatment as a corporation and also hold onto its S status.

Check each option youd like to calculate for. Our small business tax calculator has a. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

S corp owners are required to pay themselves a reasonable salary as employees and that salary is subject to payroll taxes more on this below. Social Security and Medicare. As of this writing the corporate income tax rate is 21 meaning your net business income will be taxed at that rate and not at an individual tax rate.

To find this information enter your BBL at NYC Property and select. C-Corp or LLC making 8832 election. AS a sole proprietor Self Employment Taxes paid as a Sole.

An S-Corp can offer a massive tax savings on your freelance income if youre an above-average income earner for your geographic location. Annual cost of administering a payroll. Estimated Local Business tax.

And to take the rest.

Try Our Free Corporation Tax Calculator Biztaxwiz

S Corp Vs Llc How Do Real Estate Investors Protect Themselves Capitalism Com

Taxation Of An S Corporation The Why Benefits How Rules

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

Llc Tax Calculator Definitive Small Business Tax Estimator

S Corporations Vs Llc Example Of Self Employment Income Tax Savings My Money Blog

3 More Important Ways To Build A Strong Financial Foundation For Your New Business Smallbizclub

S Corp Income Tax Rate What Is The S Corp Tax Rate

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax Calculator

Single Member Llc To S Corp Benefits Drawbacks More

Llc Vs Corporation What Is The Difference Between An Llc And A Corporation Mycorporation

Tax Difference Between Llc And S Corp Llc Vs S Corporation Explanation Freelance Tax 1099 Tax Youtube

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

S Corp Payroll Taxes Requirements How To Calculate More

S Corp Vs Llc Everything You Need To Know

Quickly Discover How Incorporating An Llc Can Save Money On Taxes Using An S Corporation Tax